Before the COVID-19 pandemic, passenger numbers had been expected to double over the next 15 years, meaning significant growth in aerospace demand. Current estimates downgrade this by at least 25 percent. The need for 38,000 new aircraft with a value of $7 trillion over the next two decades must now be reexamined. The challenge facing analysts and forecasters, however, is the number of variables and unknowns confronting such a re-think. The long-term pathology of COVID-19 and the potential of recurring epidemics: the latter will clearly hold severe implications for the global economy generally, the former may well represent negative health impacts yet to surface. Notwithstanding, there are a number of trends that stand out as near certainties:

Before the COVID-19 pandemic, passenger numbers had been expected to double over the next 15 years, meaning significant growth in aerospace demand. Current estimates downgrade this by at least 25 percent. The need for 38,000 new aircraft with a value of $7 trillion over the next two decades must now be reexamined. The challenge facing analysts and forecasters, however, is the number of variables and unknowns confronting such a re-think. The long-term pathology of COVID-19 and the potential of recurring epidemics: the latter will clearly hold severe implications for the global economy generally, the former may well represent negative health impacts yet to surface. Notwithstanding, there are a number of trends that stand out as near certainties:

- A medium-term fall in leisure travel and tourism (reducing demand for planes).

- A big push in the development of autonomous logistics (pilot-free planes).

- A permanent shift in perception towards business travel regarding sales, conferences, and face-to-face negotiations (further reducing flight demand).

- Airlines will enter into a period of survival and restructuring (with implications for cost-cutting and raising efficiencies).

- The impact of unprecedented levels of government financial support matched with a degree of intervention on the future direction of the industry. See (6) below.

- The continued push towards carbon emission reduction within aerospace demanded by national governments which will further the development of electric and hybrid powered aviation.

- The creation of an entire new air-transport ecosystem based on autonomous drones and air-pods as part of a wider Urban Air Mobility (UAM) system. See Fig. 1 below.

- Increase in demand for private jets and prop planes.

While these factors mark potentially enormous challenges, we must not underestimate the ingenuity of remedial actions being undertaken in each case by industry and government especially in regard to increasing passenger safety and raising travel-consumer confidence. While the success of these actions is speculative, we can be sure of is that determined efforts will be brought to achieve solutions. Equally, whether the pandemic proves recurring or not, we can expect airports and other travel centers to adopt mass health-screening technologies that are both preventative in nature (e.g., ultra-violet robotics and personal tracking) and diagnostic (e.g., infrared and other remote bio-sensing). Many of these will be built into the security check systems already in place, as well as the wider infrastructure of travel centers. The greater the effectiveness of these measures, the higher the level of consumer confidence, the greater numbers of people will want to fly.

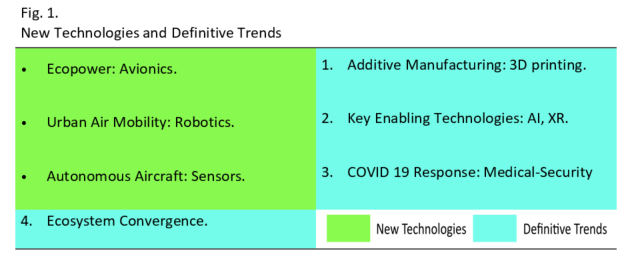

Many of these changes will build on where new technologies most effectively meet rising global needs. More particularly, we consider those technologies/needs cited in Fig. 1. which, while not an exhaustive list, is indicative. For would-be vendors, engagement already anticipated some degree of business reorientation to secure a sustainable commercial presence, but these needs will now intensify post-COVID. Linked to all this is the broader global context: the intersection of commercial aptitude with technology (including advanced autonomics), politics, trade wars, military ambition, defense strategies, and geo-economic shifts. The remainder of this blog considers the new technologies with the definitive trends considered in part two.

New Technologies

Eco-power: Avionics

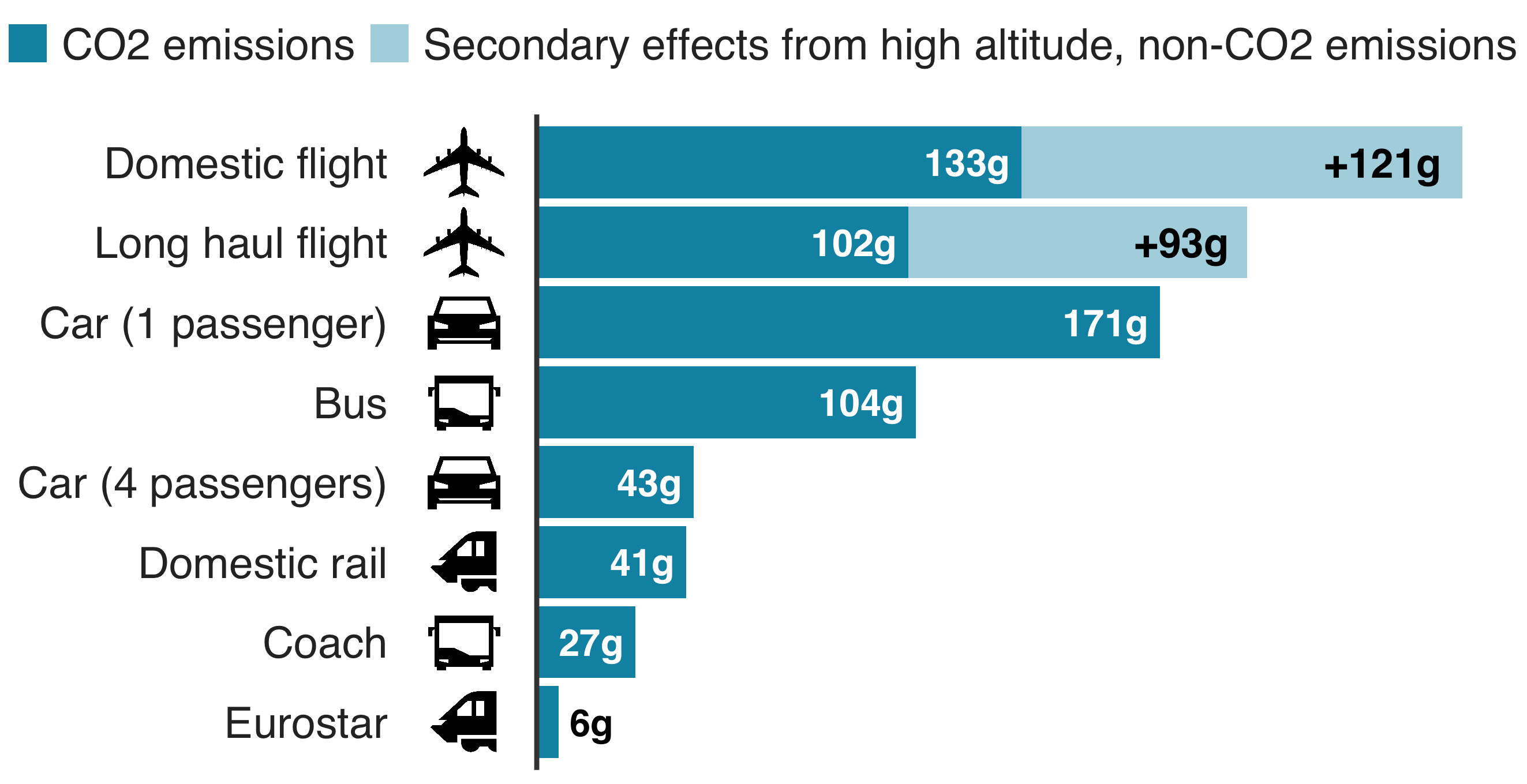

For reasons underscored in Fig. 2 below, decarbonization in the airline industry remains a high-priority in Europe and Asia (China having most to lose if mean global temperatures rise 2°C). This imperative provides a high degree of assurance that the development of electric and hybrid propulsion for aircraft remains firmly on technical and commercial roadmaps. In response, electric, hybrid eco-technologies, and autonomous flying are set to dominate short-haul flights/aircraft development and manufacturing. These same technologies give rise to a new sector of drones, passenger/cargo air-pods, and wider Urban Air Mobility (UAM) vehicles that exploit the new aero-structures and advanced materials being developed for the long-haul sector. If anything, COVID 19 has quickened these developments adding to our sense of

confidence as regards short-term growth proving both accelerating and sustainable into the medium term (five to 15 years). In turn, these factors will spill-over and feed into the ecosystems of medical, security, defense, nuclear, oil and gas, and automotive/vehicular.

Fig. 2. CO2 Emissions Per Passenger Per Kilometer Travelled

Source: BBC

Each of these sectors is rapidly evolving and provide a wide variety of opportunities to researchers, developers, and manufacturers. The more significant part lies with those global companies leading the development of electric or hybrid/electric propulsion systems, or who are working with existing technologies to reduce their carbon footprint significantly. In all these cases, flights will be made considerably quieter and costs reduced. The same systems will also support the emerging Urban Air Mobility (UAM) ecosystem (see below for more detail). Apart from large aerospace and defense companies like Boeing, Airbus, BAE, Raytheon, Rolls-Royce, and Safran, numerous startups are looking for partners such as Scandinavia's Heart Aerospace to deliver one of the world's first electric airliners by mid-decade.

Urban Air Mobility: Robotics

The development of UAM vehicles is expected to accelerate technologically, then achieve a high level of commercial success despite the practical challenges that still need to be ironed out. These include, for example, the formulation of regulations for pilotless vehicles, airworthiness certifications, and the use of airspace. Implementing efficient energy management systems, onboard sensors, collision detection systems, and other advanced technologies will also need to be tackled. In addition, the industry needs to plan and build takeoff and landing zones, parking lots, charging stations, and vertiports; in other words, the required infrastructure to make UAM work. Apart from this, creating a robust air traffic management system integrated with different modes of transport will be needed to enable globally linked logistics. Lastly, the industry will require a proven operational and mechanical safety record to overcome psychological challenges associated with the idea of flying in an unmanned aircraft. In this respect, avionics will build on vehicle manufacturers' experience of LiDAR/sensor and AI technologies and the subsequent testing of vehicles and the development of a robust regulatory framework.

Autonomous Aircraft: Sensors

Although commercial aircraft manufacturers are increasingly relying on automated flight controls, including automated cockpits, the commercial aerospace sectors' final aim is a full transition to fully automated flight decks. Such a transformation will likely reduce the number of crew members in the cockpit, resulting in lower costs for airlines. Moreover, automated flight decks would also address the pilot shortage issue currently faced by the aviation industry, which will likely be accentuated when the commercial aircraft fleet returns to growth. Autonomous flight vehicles share the same technological fundamentals as drones and self-drive automobiles (sensors, m2m, m2x communication, low-latency, advanced software, AI, robotics, encryption, etc.). These technologies allow them to be plugged into a universal networked system serving civilian needs (such as providing fully automated seaport operations or travel health monitoring) or where these are battlefield/defense or security scenarios into military, police, or combined systems.

This first blog of two has examined the potential impact of three new technologies on the aerospace market over the next half-decade. These were chosen for both their importance within the sector, but also as being highly representative of other technologies and their impact on vendor requirements. In this respect fluidity, agility, cost-consciousness, technological engagement and anticipation, swift development and the ability to meet demand with efficient systems are paramount. The second blog will undertake a similar approach but examine four definitive trends affecting the entire ecosystem—including AI and other Key Enabling technologies, Additive Manufacturing and the implications of ecosystem convergence.

----

Dr. Anthony O'Sullivan

Palomar Technologies

Strategic Market Research Specialist