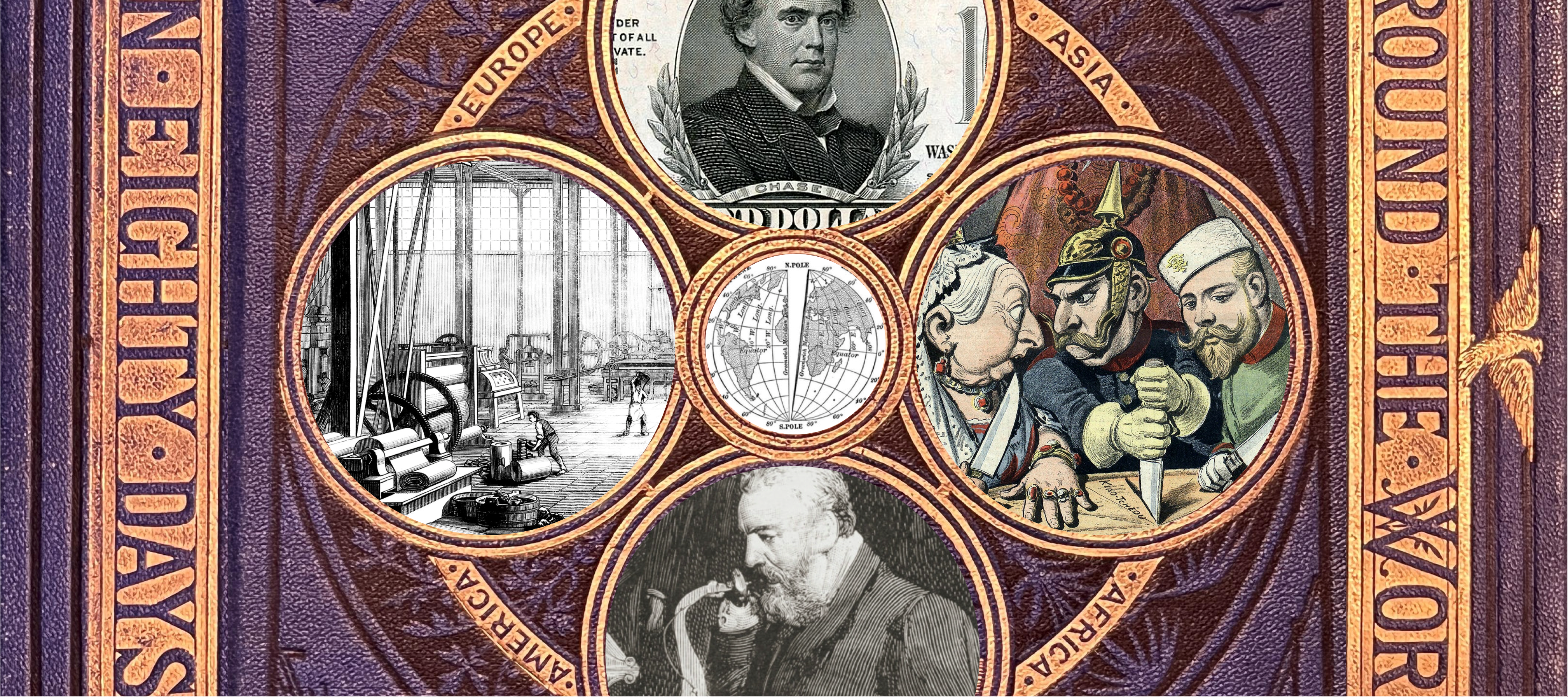

With due apologies to Jules Vern and his famous novel, we begin our 2024 blog series with an opening theme of “Around the World in Five Trends”. These are trends that will be critical in shaping the year ahead. More specifically, these relate to the direction of technical innovation, national macroeconomic policy, local automation, global competition, and international standardization.

Without a doubt, the next twelve months (and well beyond) will witness continued banking on expertise and innovation, literally. Ours may be the age that ushers in artificial intelligence, but quantum realities dictate it will never equal or displace human ingenuity. Mimic may be, but never replace. A company that lacks in this area, whatever else it has going for it, is at best a machine without an engine. Innovators give our companies vision and direction; experts and professionals turn that vision into reality. Without them we have nothing to offer tomorrow’s world. We may not have an Isambard Kingdom Brunel or an Alexander Graham Bell, but any company worth its salt will continue to seek out and invest in men and women that possess their spirit, however modest a portion that may be. Of course, investing in human capital without the necessary physical corollaries does not work, it has to be both. Judging by statements of intent, technical roadmaps and growing capitalized values across the semiconductor industry, eye watering amounts of capital already are, and will continue to flow into the sector over the next decade.

2024 will be another year of global macro-economic uncertainty, by which we mean government and institutional policy outcomes. The current narrative states “inflation has finally been tamed” but, only two years ago, these same institutions were assuring us “that price spikes would be under control in a matter of months”. Given the swiftness with which governments and central banks can move from Keynesian, to Monetarist and to Modern Monetary theory, simultaneously ignoring the 360-degree volte face in each case, we are right to doubt their forecasts. More expensive money mixed with uncertainty, however, is proving to be boon in forcing productivity. Against the constraints international pricing competition, it is the only place left for many businesses to go, which brings us to our next key trend.

Automate or die. A combination of the pandemic fall-out, inflation, a shrinking work force, and more expensive human capital unleashed a new wave of automation beginning in 2021. This is certainly going to continue to gain momentum in 2024. In the West especially, productivity levels have been languishing for decades, but immigration policies that led to a plethora of cheap labor meant that the normal forces that drive productivity were absent. However, immigration is now being outpaced by retirement, resulting in a smaller and more expense labor market. Though for different reasons, China and Japan are facing the same pressures. Thus, the imperative to automate is now not only a global one, but a global race—which ties in with our next subject.

2024 will continue the shift from of late twentieth century globalization to the very different dynamic of two competitive ecosystems. That being said, these remain surprisingly co-operative and complementary. Of course, there is rivalry, but there has always been rivalry; we just covered it with a polite smile. De-globalization and re-shoring, taken without political hype, allow us to calmly recognize that the shift away from the old order actually has many benefits. Take one example: if vast tranches of taxpayer money to localize key technologies distorts the free market, it is only for the short-term. Governments are doing the easy bit, paying for much of the initial green field development. Private capital is doing the hard bit, raising local productivity and efficiency to the point where sustainable profit endures once market equilibrium is restored. This is as much an Eastern phenomenon as Western. As the global automotive industry learned from the 1980s, no amount of patriotism will maintain local sales in the face of cheaper and better foreign alternatives. This is even more true of the semi-conductor ecosystem.

Other benefits of this shift include the economics of diversification. If globalization had a weakness, it was to force too many eggs into the one basket. Consequent to re-shoring, Western companies will lessen their dependence on Chinese markets, while China becomes less dependent on the West. Both benefit. Both are forced to innovate and raise efficiencies. Both are forced to deepen local synergies. Both have to “up their game”. Yet, despite the occasional rhetoric, the incentives to trade, communicate, and co-operate on critical issues remains as robust as ever. No one wants to cut off their nose to spite their face, especially if there are stock holders to answer to. Beyond this, there are common goals to which we all aspire; the move to carbon-zero, enhanced data security, AI safety, de-escalation protocols, pandemic readiness, and so on. The need to work together in these areas remains vital.

Our final trend must be the unalloyed global commitment to standardization across a range of key and critical technologies. Mention has already been made of artificial intelligence. Other areas range from agreeing protocols covering the many, many strands pertaining to 6G communications, to global push to standardize chiplet interconnects. Both witnessed solid progress in 2023 under the auspices of UCIe and the ITU respectively. On the basis that these two technologies mark advances of three orders of magnitude in the many sectors they touch, they will unleash opportunities for innovation not witnessed since the first industrial revolution, which pretty much brings us back to where we started this blog: investment in innovation and expertise. It has taken fifty years for the global semiconductor industry to attain a collective value of $500 million, and today there are few doubts this will reach $1 trillion before the end of the decade. On this note, we at Palomar, would like to wish all our readers a happy, innovative and prosperous 2024.

----

Dr. Anthony O'Sullivan

Strategic Market Research Specialist

Palomar Technologies